Problem Description

This STATA assignment delves into Belenzon, Chatterji, and Daley's 2017 research, investigating the connection between firms named after their founders (eponymy) and their performance. Using a vast dataset spanning 2002-2012, the study's central question is whether eponymous firms outperform their non-eponymous counterparts. Furthermore, the analysis employs STATA to explore the significance of firm and owner effects on these performance outcomes.

Assignment Solution: The Relationship Between Firm Naming and Performance

Introduction

This assignment examines the research conducted by Belenzon, Chatterji, and Daley (2017), which explores the relationship between eponymy (firms being named after their owners) and firm performance. The authors propose that the namesake of a firm can create a stronger association between the entrepreneur and the company, resulting in reputational benefits that impact firm performance. The primary research question revolves around understanding whether firms named after their founder exhibit better performance. Additionally, this analysis utilizes STATA, a powerful statistical software, to perform the required data analysis.

Problem Description

In their study, Belenzon, Chatterji, and Daley (2017) present a baseline specification in the form of a regression model:

(ROA_it=α_1 Eponymous_it+Z_1it β_1+⋯+Z_dit β_d+η_j+τ_t+c_c+u_it,)

In this equation:

ROA_it represents return on assets for firm i in year t.

Eponymous_it is a binary indicator variable that equals one if the firm's name in year t includes the name of the owner, and zero otherwise.

Z_1it, ..., Z_dit represent time-varying control variables.

η, τ, c are sets of dummies representing three-digit standard industrial classification (SIC) codes, country, and year.

The dataset covers more than 6 million observations and includes data on over 1 million firms for the period 2002-2012.

Solution

(a) Predicting α_1

Belenzon, Chatterji, and Daley (2017) propose that eponymy has a signaling effect, strengthening the association between the entrepreneur and the firm. High-ability entrepreneurs are more likely to use eponymous names, as this enhances the reputation of the firm. Therefore, we predict that α_1 is positive, indicating that eponymous firms have better performance.

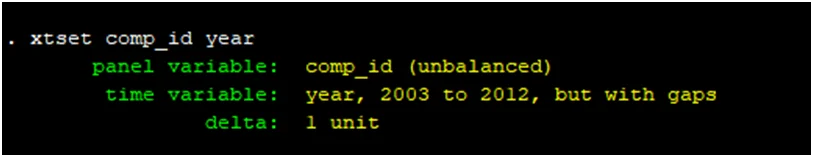

(b) Balanced Panel Data

The authors do not have balanced panel data. The data set is unbalanced, as indicated by the presence of missing observations in the model. This lack of balance can be problematic when performing certain statistical analyses.

(c) Firm Fixed Effect

In the basic specification, the authors did not include a firm fixed effect. This could be because only 0.3 percent of firms changed their eponymy status during the sample period, which might not be sufficient to justify including firm-specific fixed effects. Additionally, the authors found that the time dimension is statistically significant for all periods, suggesting that the effect varies over time.

(d) Owner Fixed Effect

To control for owner fixed effects, dummy variables or in-group estimation methods can be used, which are suitable for addressing unobserved individual-level heterogeneity. This is especially important when the same individual owns multiple firms, as it allows us to separate the effect of the owner from the eponymy status.

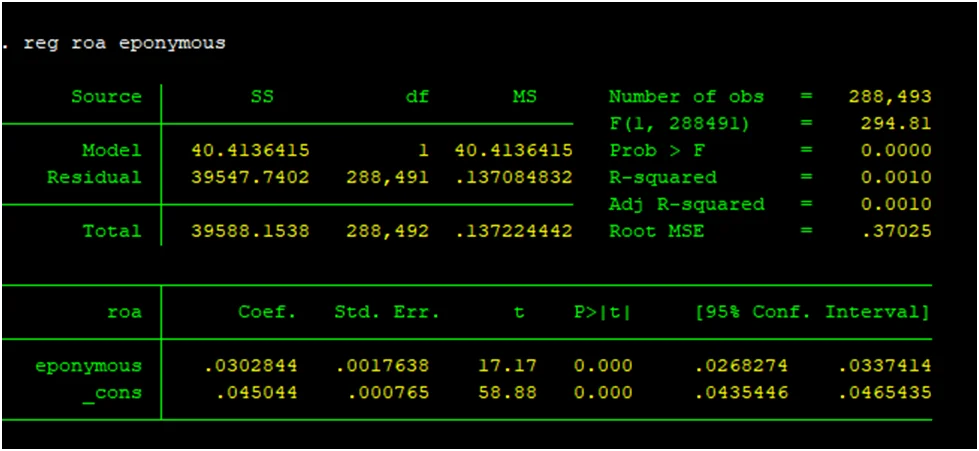

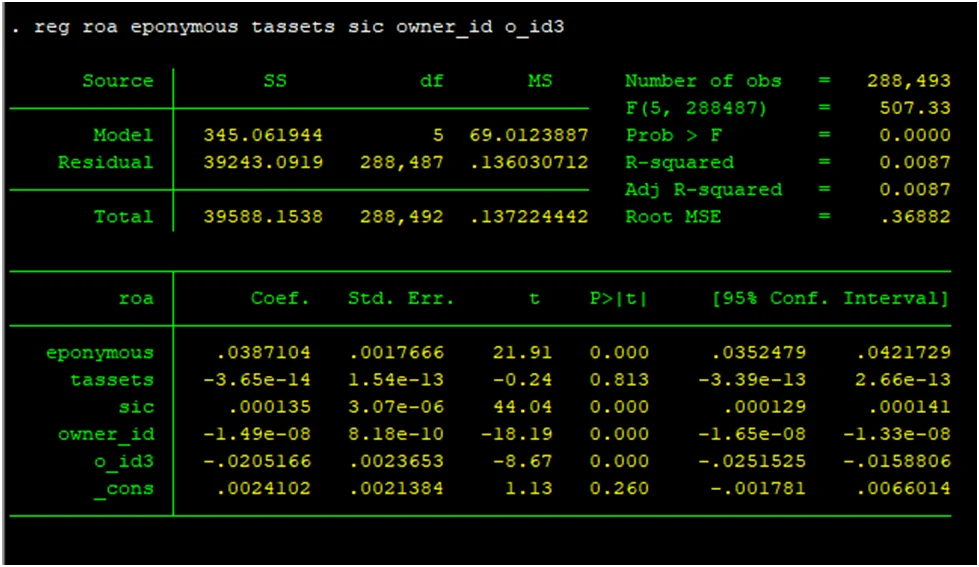

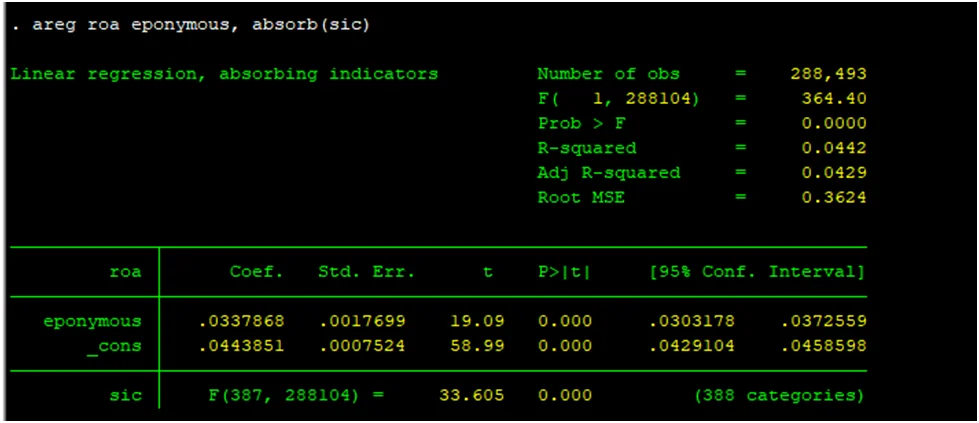

(e) Estimation Results with STATA

Using the dataset provided, the model from part (a) was estimated with the areg command in STATA, clustered by firm. The results show that individuals who reveal their names have a higher return on assets compared to those who do not.

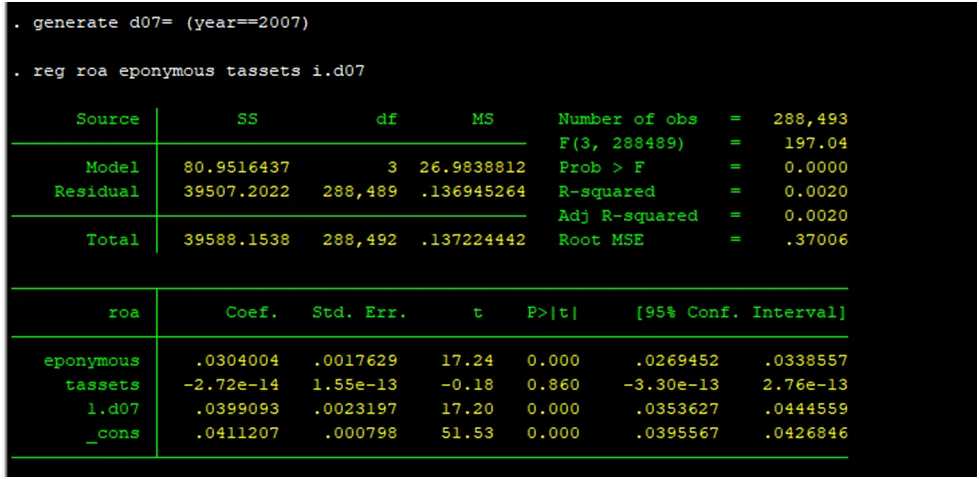

(f) Estimation Results for 2007

In the year 2007, the same model was estimated. The results indicate that the individuals who disclosed their names had a 0.03 unit higher asset return, which is consistent with the earlier model.

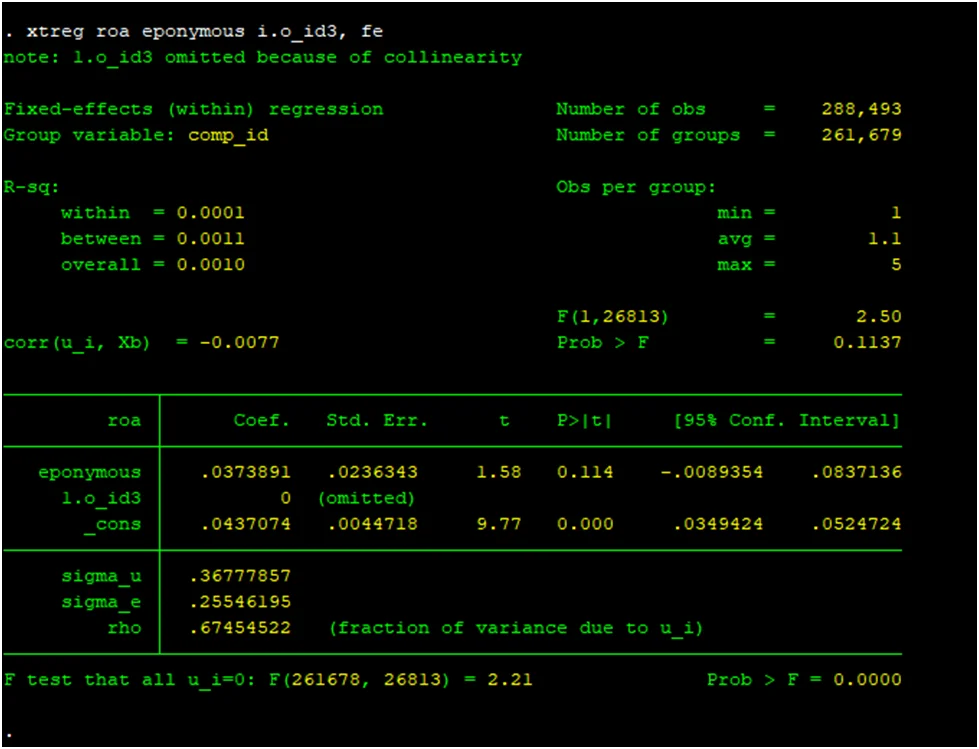

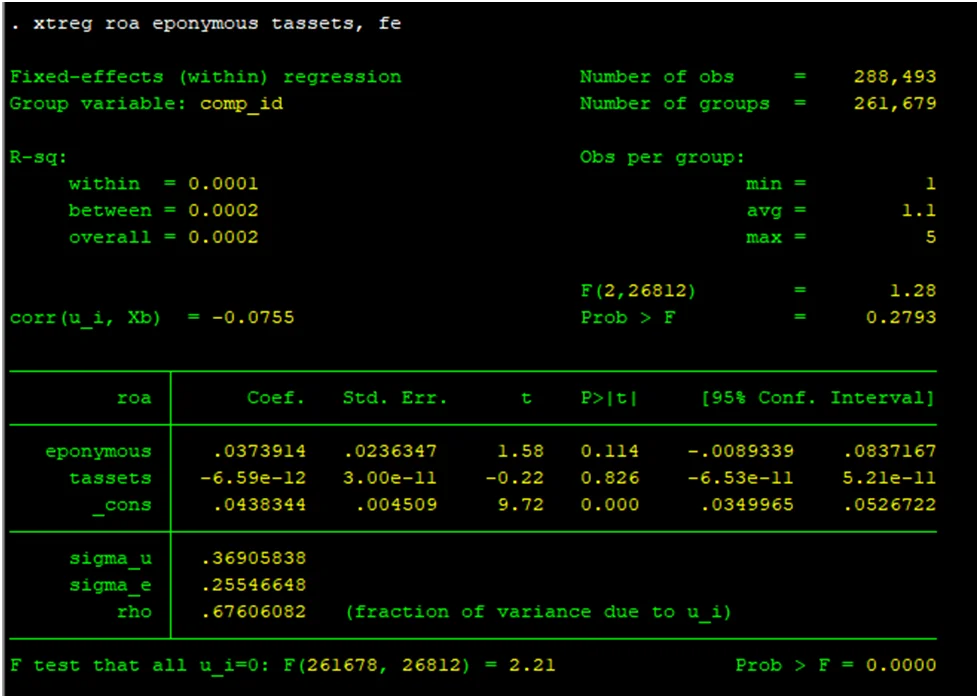

(g) Firm Fixed Effect Estimation

The model was further refined by including the firm fixed effect.

The xtset and xtreg commands in STATA were used to run a panel data regression. The standard error was found to be 0.25, and the rho coefficient was 0.67, suggesting a high interaction between units.

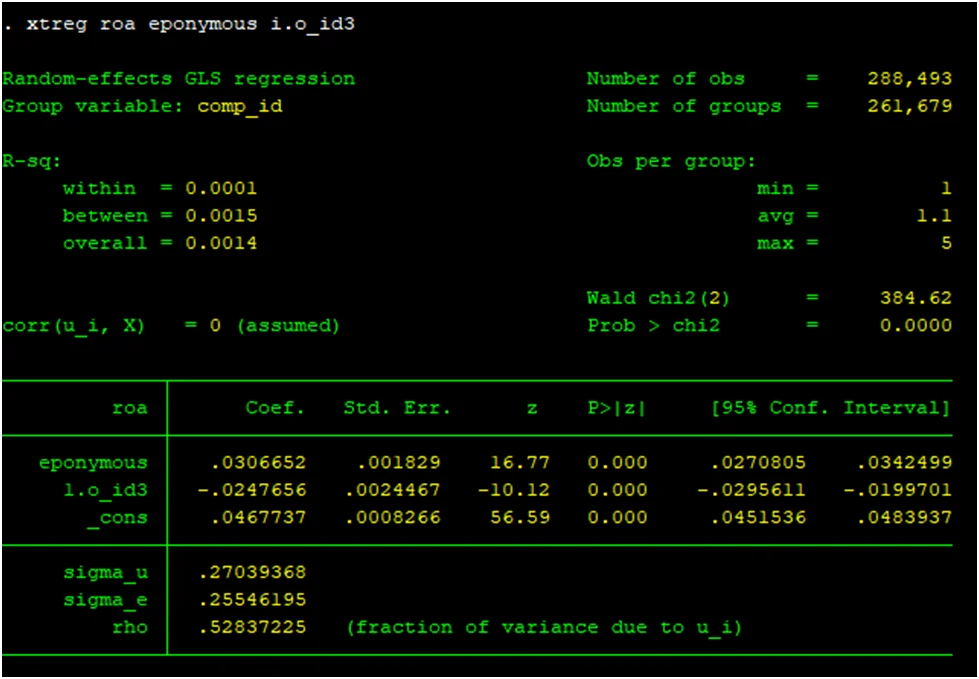

(h) Sample Restriction for Multiple Businesses

The analysis was restricted to owners with at least two different businesses, allowing for the investigation of the effect of owning multiple companies on asset returns.

In conclusion, this assignment offers a comprehensive analysis of the research conducted by Belenzon, Chatterji, and Daley (2017) on the relationship between eponymy and firm performance. It uses the statistical software STATA to estimate various regression models, providing insights into the impact of firm naming on financial performance and the importance of controlling for different types of fixed effects.